Policy Memo

Please, Senators, Pass (on) the Pork

There are real growth provisions in the One Big Beautiful Bill, and Congress should pay for those ahead of expensive, useless giveaways.

As the Senate marks up its version of the One Big, Beautiful Bill - the tax and reconciliation bill that is also meant to pay for many of Trump’s biggest campaign promises, one thing has become clear: growth and giveaways cannot coexist.

Both this bill and its House counterpart, which was passed last month, aim to make permanent a large portion of the Tax Cuts and Jobs Act of 2017 (TCJA). Both will cost, depending on the scorer, between $2 trillion and $6 trillion over the next 10 years.

The Congressional Budget Office agrees. On June 17, the CBO released a dynamic score of the House version, which counts its cost in light of the economic effects of the bill and estimates a $ 2.7 trillion deficit increase over the 10-year window.

That score is worse than their initial, static score, because interest rate increases would outpace the gains of increased economic output. These estimates corroborate a point made in our most recent policy recommendations: the national debt is an existential threat to the very economic growth policymakers are depending on to protect us from disaster.

In spite of that, many Congressional Republicans have insisted that the bill is a long-term deficit cutter – mostly due to far-fetched assumptions about economic growth.

The Deficit Path

As written, the bill seems likely to accelerate the US down an already unsustainable fiscal path. The national debt currently stands at roughly 120 percent of GDP. Large-scale credit rating agencies have already downgraded US debt (with the latest explicitly citing the House version of the OBBB), and the bond market has started to show some softness. Most US debt is held by investors, and accounting gimmicks do not fool them.

For too long, the US has avoided facing fiscal reality. The result has been a slow-motion disaster. Interest on our nation’s debt has already become the second-largest government expense, taking up approximately a quarter of all tax revenue. Within a few years, it will eclipse all other spending.

Lawmakers keen to pass the bill have engaged in a smear campaign against the CBO, alleging that their estimates of growth are unduly pessimistic. But MDF has suggested just the opposite before: CBO’s interest rate estimates might be unrealistically sanguine. At a (very possible) 5 percent interest rate, the US will be spending as much as two-thirds of all tax revenues on interest payments alone by 2054, at which time the debt may be as much as three times the size of the economy.

A crisis would almost certainly intervene before then, causing a long-overdue fiscal reckoning and casting indiscriminate and unpredictable suffering far and wide.

Increasingly, policymakers and investors have coalesced around the idea that economic growth is our best hope of forestalling that crisis and mitigating its pain when it happens. At the New York Times Dealbook Summit late last year, Jeff Bezos observed, “You’re going to solve the problem of national debt by making it a smaller percentage of GDP, not by shrinking the national debt.” The year before, then-presidential challenger Vivek Ramaswamy offered 5 percent economic growth as the only realistic solution to the dilemma between tax increases and spending cuts. And shortly after the House passed the OBBB, Elon Musk pointed out that “only radical improvements in productivity can save our country.”

The Growth Mandate

Since growth is not merely an essential part of the remedy for America’s long-term fiscal ailment but also the assumption that makes the House’s bill make sense, the Senate should prioritize provisions in the law that provide the most direct link to growth.

Measured in this way, the most significant weaknesses in the House bill are that the business tax provisions are temporary, creating yet another arbitrary cliff for those making R&D or business infrastructure decisions.

The House Bill achieves “cost savings” by sunsetting the provisions for bonus depreciation, expensing R&D, and incentives around fresh capital investment. The Senate, wisely, is looking to make these measures permanent, at a cost of nearly half a trillion dollars more (per JCT).

Empty Calories at the Pork Buffet

At the same time, arbitrary giveaways waste all the savings gained by the sunset gimmick and then some, while creating expensive economic distortions, complicating the tax code, and rewarding rent-seekers. Altogether, there are some 30+ tax pork provisions, providing more than a dollar of new expense for every dollar saved by sunsetting desperately needed growth provisions in the bill.

Here are some of the porkiest offerings:

Tax

Business development corporation income qualifies for the qualified business income deduction (JCX-22-25R; all other figures taken from JCX 26-25R)

10 yr Cost

(in millions of dollars)

$

10,734

Tax

No tax on tips (sunset 12/31/28)

10 yr Cost

(in millions of dollars)

$

39,681

Tax

No tax on overtime (sunset 12/31/28)

10 yr Cost

(in millions of dollars)

$

124,016

Tax

Enhanced deduction for seniors (sunset 12/31/28)

10 yr Cost

(in millions of dollars)

$

66,263

Tax

No tax on car loan interest (sunset 12/31/28)

10 yr Cost

(in millions of dollars)

$

57,673

Tax

Tax credit for contributions of individuals to scholarship granting organizations (credit sunset 12/31/29)

10 yr Cost

(in millions of dollars)

$

20,442

Tax

Reinstatement of partial deduction for charitable contributions of individuals who do not elect to itemize (sunset 12/31/28)

10 yr Cost

(in millions of dollars)

$

6,947

Tax

Exclusion for certain employer payments of student loans under educational assistance programs made permanent and adjusted for inflation

10 yr Cost

(in millions of dollars)

$

11,238

Tax

Trump accounts

10 yr Cost

(in millions of dollars)

$

17,345

Tax

Exclusion of interest on loans secured by rural or agricultural real property (sunset 12/31/28)

10 yr Cost

(in millions of dollars)

$

1,095

Tax

Treatment of certain qualified sound recording productions

10 yr Cost

(in millions of dollars)

$

153

Tax

Modifications to low-income housing credit

10 yr Cost

(in millions of dollars)

$

14,110

Tax

A Virgin Islands exemption to a law cracking down on tax havens.

10 yr Cost

(in millions of dollars)

$

883

Tax

Extension and modification of clean fuel production credit (sunset 12/31/31)

10 yr Cost

(in millions of dollars)

$

45,357

Tax

The Golden Dome Program

10 yr Cost

(in millions of dollars)

$

24,746

Tax

Eliminating the Tax on Silencers

10 yr Cost

(in millions of dollars)

$

1,478

All told, in tax giveaways and new expenses for (yet more) farm subsidies and energy giveaways, the bill spends over half a trillion dollars that could be spent on making smart cuts permanent and stabilizing the investment base that will grow wages, wealth, and GDP.

If the pork doesn’t kill you, the SALT will.

The first thing to say about the State and Local Tax Exemption (SALT), which is less obviously “pork” but still amounts to a giant handout to wealthy taxpayers in blue states, is that it encourages bad policy.

SALT allows high-tax states to spend recklessly and avoid accountability to their citizens. If states are, as Justice Brandeis once affirmed, “laboratories of democracy,” SALT poisons the experiment by insulating states from negative feedback loops for their bad policy.

Consider two states like New York and Florida - similarly populated states, both of which are high-tourism, high-industry, demographically and economically mixed, and big.

Per capita, New York spends 133 percent more than the Sunshine state. In spite of having arguably the world’s capital city, New York’s population has grown only 4 percent over the last 25 years, while Florida has boomed, thanks in no small part to New Yorkers.

SALT exemptions buffer New York from this trend.

Similarly, California’s budget dwarfs the budgets of Florida and Texas combined.

To what end? Since 2019, the Golden State’s government’s effort to decrease homelessness has spent over $200,000 per homeless person, only to have it increase by 24 percent since Governor Newsom declared fixing the problem to be a “statewide mission.”

Similarly, both New York and California have exploded Medicaid expenditures, with both states spending more per capita on Medicaid than Florida spends in toto.

These developments accelerated while the SALT deduction was $10,000. The House Bill quadruples the benefit; what do we expect will happen next?

So much for SALT as bad policy. It is also highly regressive. As CRFB has shown, while SALT benefits already disproportionately benefit high-earners, raising the cap by $30,000, as the House Bill does, delivers nearly all relief to people earning over $400,000 per year.

Finally, this irresponsible and regressive policy is expensive, totaling $350 billion over the 10-year budget window.

A Plan to Bulk Up the Economy

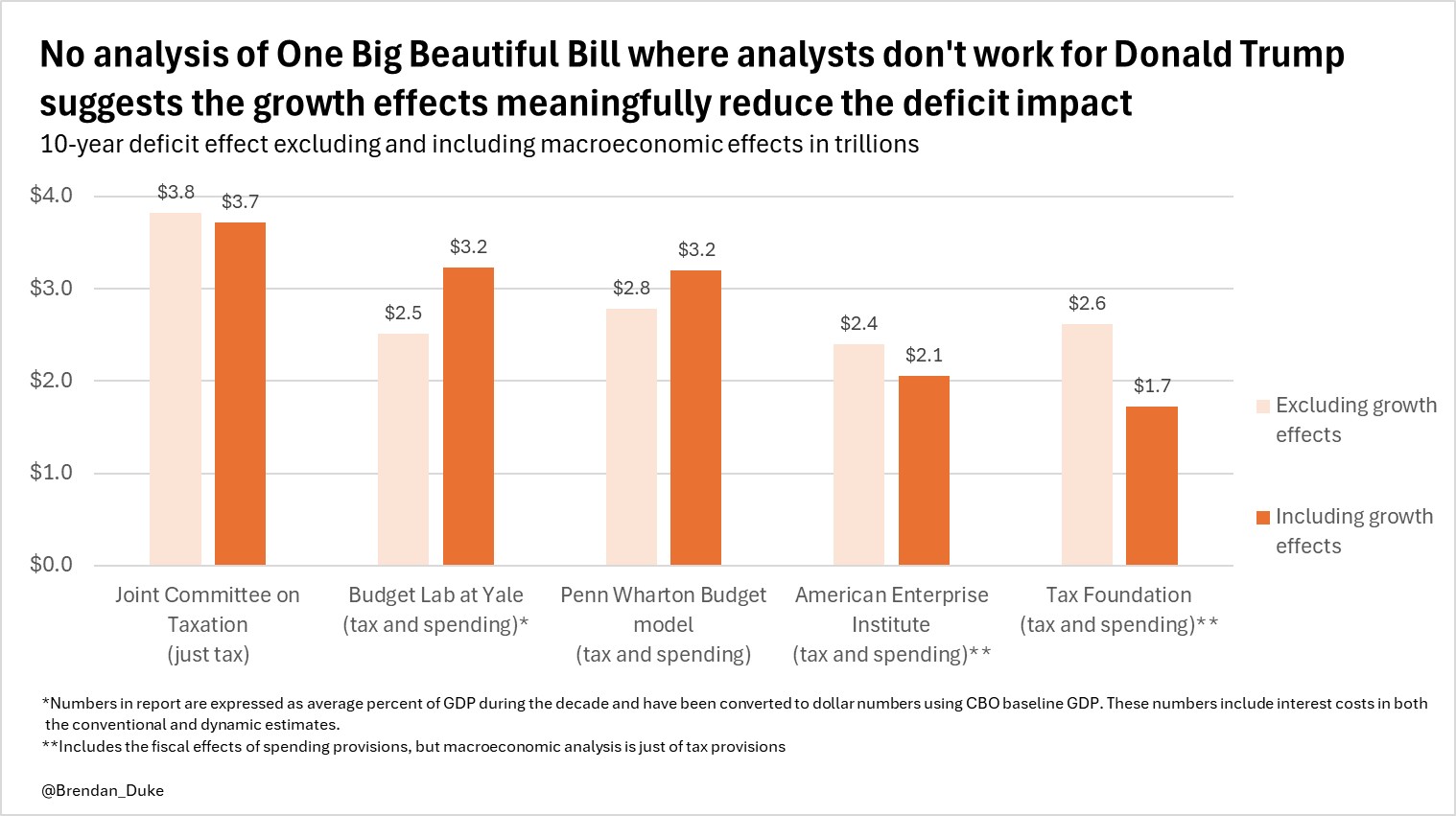

In the end, the bill is pork-rich and growth-poor at a time when growth needs to be a high-priority policy target. The Senate’s draft version shows serious promise by incentivizing business investment and zeroing out the additions in the SALT cap, for now at least.

This is a start. Still, debates around tax policy in the country are largely disconnected from reality. House leadership has promulgated growth assumptions of 2.6 percent per year as a result of the bill, along with other legislation they have planned. That would be remarkable, given that most scorers of this bill have found it to have little positive effect on growth (or, like Penn, Yale, and now CBO, even a negative one).

No analysis of One Big Beautiful Bill where analysts don’t work for Donald Trump suggests the growth effects meaningfully reduce the deficit impact

10-year deficit effect excluding and including macroeconomic effects in trillions

*Numbers in report are expressed as average percent of GDP during the decade and have been converted to dollar numbers using CBO baseline GDP. These numbers include interest costs in both the conventional and dynamic estimates.

**Includes the fiscal effects of spending provisions, but macroeconomic analysis is just of tax provisions

@Brendan_Duke

This is the fiscal dilemma: if the TCJA is not extended or made permanent, the American people will experience the most significant tax increase in their history – hardly a pro-growth development. At the same time, debt growth is currently outpacing GDP, interest payments are consuming a quarter of tax revenue, and primary deficits are increasing by 6 percent of GDP each year.

Congress is baking growth assumptions into laws that would otherwise balloon the deficit, when we already need all the GDP growth we can get for a fiscal situation that is careening out of control. We don’t just need to attack the pork in this bill; we need pro-growth reduction in the already-existing primary deficit. Happily, ideas on how to do this are not in short supply.

We cannot afford to waste the runway that economic expansion might buy us on new handouts for pet causes of elected officials; much less can we afford to hamstring growth to make budgetary room for even more pork.

DISCOVER OUR MISSION

Fueling a movement for fiscal responsibility and a stronger American future.

Join the movement

Policy Memo

Please, Senators, Pass (on) the Pork

There are real growth provisions in the One Big Beautiful Bill, and Congress should pay for those ahead of expensive, useless giveaways.

As the Senate marks up its version of the One Big, Beautiful Bill - the tax and reconciliation bill that is also meant to pay for many of Trump’s biggest campaign promises, one thing has become clear: growth and giveaways cannot coexist.

Both this bill and its House counterpart, which was passed last month, aim to make permanent a large portion of the Tax Cuts and Jobs Act of 2017 (TCJA). Both will cost, depending on the scorer, between $2 trillion and $6 trillion over the next 10 years.

The Congressional Budget Office agrees. On June 17, the CBO released a dynamic score of the House version, which counts its cost in light of the economic effects of the bill and estimates a $ 2.7 trillion deficit increase over the 10-year window.

That score is worse than their initial, static score, because interest rate increases would outpace the gains of increased economic output. These estimates corroborate a point made in our most recent policy recommendations: the national debt is an existential threat to the very economic growth policymakers are depending on to protect us from disaster.

In spite of that, many Congressional Republicans have insisted that the bill is a long-term deficit cutter – mostly due to far-fetched assumptions about economic growth.

The Deficit Path

As written, the bill seems likely to accelerate the US down an already unsustainable fiscal path. The national debt currently stands at roughly 120 percent of GDP. Large-scale credit rating agencies have already downgraded US debt (with the latest explicitly citing the House version of the OBBB), and the bond market has started to show some softness. Most US debt is held by investors, and accounting gimmicks do not fool them.

For too long, the US has avoided facing fiscal reality. The result has been a slow-motion disaster. Interest on our nation’s debt has already become the second-largest government expense, taking up approximately a quarter of all tax revenue. Within a few years, it will eclipse all other spending.

Lawmakers keen to pass the bill have engaged in a smear campaign against the CBO, alleging that their estimates of growth are unduly pessimistic. But MDF has suggested just the opposite before: CBO’s interest rate estimates might be unrealistically sanguine. At a (very possible) 5 percent interest rate, the US will be spending as much as two-thirds of all tax revenues on interest payments alone by 2054, at which time the debt may be as much as three times the size of the economy.

A crisis would almost certainly intervene before then, causing a long-overdue fiscal reckoning and casting indiscriminate and unpredictable suffering far and wide.

Increasingly, policymakers and investors have coalesced around the idea that economic growth is our best hope of forestalling that crisis and mitigating its pain when it happens. At the New York Times Dealbook Summit late last year, Jeff Bezos observed, “You’re going to solve the problem of national debt by making it a smaller percentage of GDP, not by shrinking the national debt.” The year before, then-presidential challenger Vivek Ramaswamy offered 5 percent economic growth as the only realistic solution to the dilemma between tax increases and spending cuts. And shortly after the House passed the OBBB, Elon Musk pointed out that “only radical improvements in productivity can save our country.”

The Growth Mandate

Since growth is not merely an essential part of the remedy for America’s long-term fiscal ailment but also the assumption that makes the House’s bill make sense, the Senate should prioritize provisions in the law that provide the most direct link to growth.

Measured in this way, the most significant weaknesses in the House bill are that the business tax provisions are temporary, creating yet another arbitrary cliff for those making R&D or business infrastructure decisions.

The House Bill achieves “cost savings” by sunsetting the provisions for bonus depreciation, expensing R&D, and incentives around fresh capital investment. The Senate, wisely, is looking to make these measures permanent, at a cost of nearly half a trillion dollars more (per JCT).

Empty Calories at the Pork Buffet

At the same time, arbitrary giveaways waste all the savings gained by the sunset gimmick and then some, while creating expensive economic distortions, complicating the tax code, and rewarding rent-seekers. Altogether, there are some 30+ tax pork provisions, providing more than a dollar of new expense for every dollar saved by sunsetting desperately needed growth provisions in the bill.

Here are some of the porkiest offerings:

Tax

10 yr Cost

(in millions of dollars)

Business development corporation income qualifies for the qualified business income deduction (JCX-22-25R; all other figures taken from JCX 26-25R)

$

10,734

No tax on tips (sunset 12/31/28)

$

39,681

No tax on overtime (sunset 12/31/28)

$

124,016

Enhanced deduction for seniors (sunset 12/31/28)

$

66,263

No tax on car loan interest (sunset 12/31/28)

$

57,673

Tax credit for contributions of individuals to scholarship granting organizations (credit sunset 12/31/29)

$

20,442

Reinstatement of partial deduction for charitable contributions of individuals who do not elect to itemize (sunset 12/31/28)

$

6,947

Exclusion for certain employer payments of student loans under educational assistance programs made permanent and adjusted for inflation

$

11,238

Trump accounts

$

17,345

Exclusion of interest on loans secured by rural or agricultural real property (sunset 12/31/28)

$

1,095

Treatment of certain qualified sound recording productions

$

153

Modifications to low-income housing credit

$

14,110

A Virgin Islands exemption to a law cracking down on tax havens.

$

883

Extension and modification of clean fuel production credit (sunset 12/31/31)

$

45,357

The Golden Dome Program

$

24,746

Eliminating the Tax on Silencers

$

1,478

All told, in tax giveaways and new expenses for (yet more) farm subsidies and energy giveaways, the bill spends over half a trillion dollars that could be spent on making smart cuts permanent and stabilizing the investment base that will grow wages, wealth, and GDP.

If the pork doesn’t kill you, the SALT will.

The first thing to say about the State and Local Tax Exemption (SALT), which is less obviously “pork” but still amounts to a giant handout to wealthy taxpayers in blue states, is that it encourages bad policy.

SALT allows high-tax states to spend recklessly and avoid accountability to their citizens. If states are, as Justice Brandeis once affirmed, “laboratories of democracy,” SALT poisons the experiment by insulating states from negative feedback loops for their bad policy.

Consider two states like New York and Florida - similarly populated states, both of which are high-tourism, high-industry, demographically and economically mixed, and big.

Per capita, New York spends 133 percent more than the Sunshine state. In spite of having arguably the world’s capital city, New York’s population has grown only 4 percent over the last 25 years, while Florida has boomed, thanks in no small part to New Yorkers.

SALT exemptions buffer New York from this trend.

Similarly, California’s budget dwarfs the budgets of Florida and Texas combined.

To what end? Since 2019, the Golden State’s government’s effort to decrease homelessness has spent over $200,000 per homeless person, only to have it increase by 24 percent since Governor Newsom declared fixing the problem to be a “statewide mission.”

Similarly, both New York and California have exploded Medicaid expenditures, with both states spending more per capita on Medicaid than Florida spends in toto.

These developments accelerated while the SALT deduction was $10,000. The House Bill quadruples the benefit; what do we expect will happen next?

So much for SALT as bad policy. It is also highly regressive. As CRFB has shown, while SALT benefits already disproportionately benefit high-earners, raising the cap by $30,000, as the House Bill does, delivers nearly all relief to people earning over $400,000 per year.

Finally, this irresponsible and regressive policy is expensive, totaling $350 billion over the 10-year budget window.

A Plan to Bulk Up the Economy

In the end, the bill is pork-rich and growth-poor at a time when growth needs to be a high-priority policy target. The Senate’s draft version shows serious promise by incentivizing business investment and zeroing out the additions in the SALT cap, for now at least.

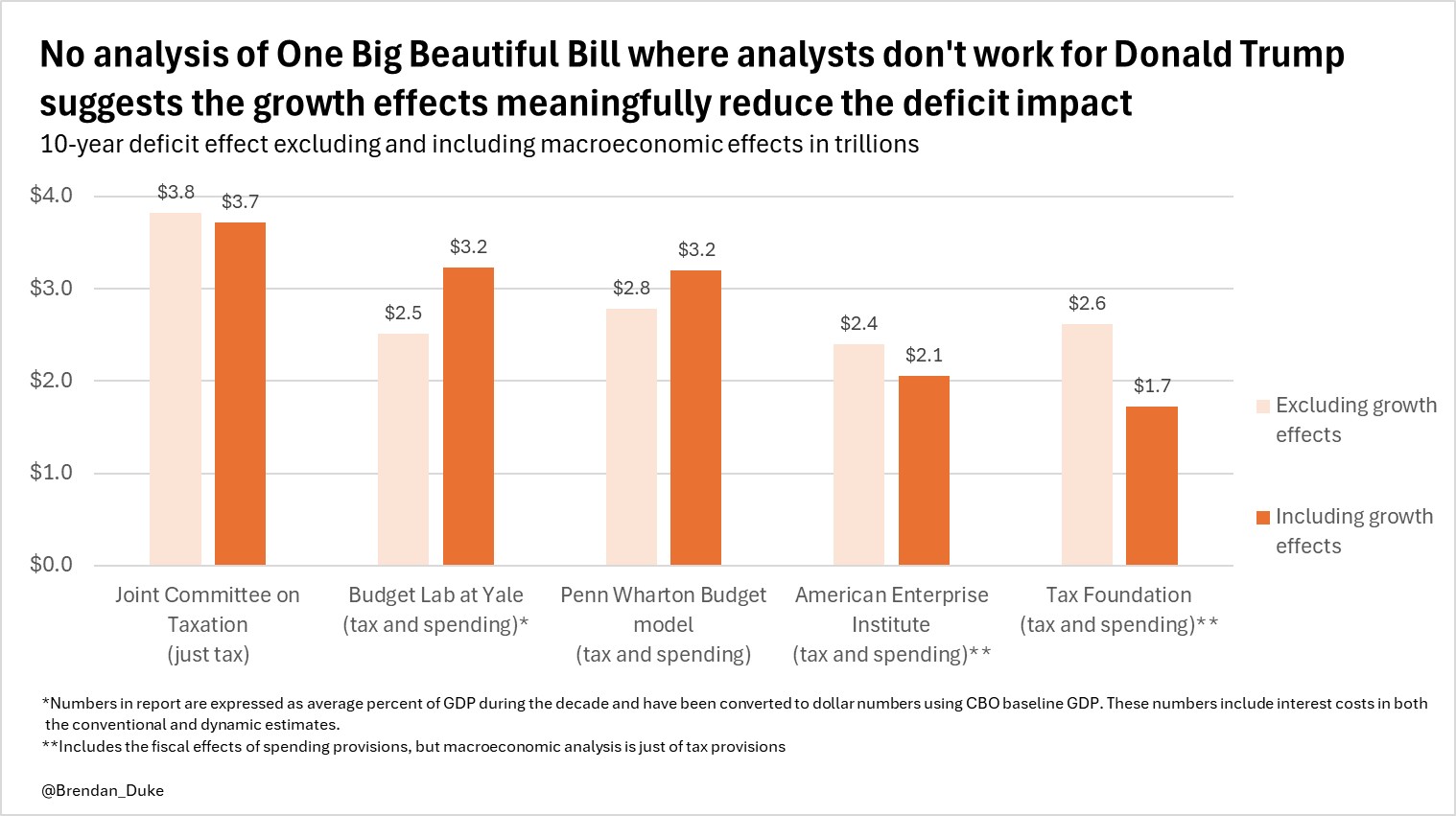

This is a start. Still, debates around tax policy in the country are largely disconnected from reality. House leadership has promulgated growth assumptions of 2.6 percent per year as a result of the bill, along with other legislation they have planned. That would be remarkable, given that most scorers of this bill have found it to have little positive effect on growth (or, like Penn, Yale, and now CBO, even a negative one).

No analysis of One Big Beautiful Bill where analysts don’t work for Donald Trump suggests the growth effects meaningfully reduce the deficit impact

10-year deficit effect excluding and including macroeconomic effects in trillions

*Numbers in report are expressed as average percent of GDP during the decade and have been converted to dollar numbers using CBO baseline GDP. These numbers include interest costs in both the conventional and dynamic estimates.

**Includes the fiscal effects of spending provisions, but macroeconomic analysis is just of tax provisions

@Brendan_Duke

This is the fiscal dilemma: if the TCJA is not extended or made permanent, the American people will experience the most significant tax increase in their history – hardly a pro-growth development. At the same time, debt growth is currently outpacing GDP, interest payments are consuming a quarter of tax revenue, and primary deficits are increasing by 6 percent of GDP each year.

Congress is baking growth assumptions into laws that would otherwise balloon the deficit, when we already need all the GDP growth we can get for a fiscal situation that is careening out of control. We don’t just need to attack the pork in this bill; we need pro-growth reduction in the already-existing primary deficit. Happily, ideas on how to do this are not in short supply.

We cannot afford to waste the runway that economic expansion might buy us on new handouts for pet causes of elected officials; much less can we afford to hamstring growth to make budgetary room for even more pork.

DISCOVER OUR MISSION

Fueling a movement for fiscal responsibility and a stronger American future.

Join the movement

Policy Memo

Please, Senators, Pass (on) the Pork

There are real growth provisions in the One Big Beautiful Bill, and Congress should pay for those ahead of expensive, useless giveaways.

As the Senate marks up its version of the One Big, Beautiful Bill - the tax and reconciliation bill that is also meant to pay for many of Trump’s biggest campaign promises, one thing has become clear: growth and giveaways cannot coexist.

Both this bill and its House counterpart, which was passed last month, aim to make permanent a large portion of the Tax Cuts and Jobs Act of 2017 (TCJA). Both will cost, depending on the scorer, between $2 trillion and $6 trillion over the next 10 years.

The Congressional Budget Office agrees. On June 17, the CBO released a dynamic score of the House version, which counts its cost in light of the economic effects of the bill and estimates a $ 2.7 trillion deficit increase over the 10-year window.

That score is worse than their initial, static score, because interest rate increases would outpace the gains of increased economic output. These estimates corroborate a point made in our most recent policy recommendations: the national debt is an existential threat to the very economic growth policymakers are depending on to protect us from disaster.

In spite of that, many Congressional Republicans have insisted that the bill is a long-term deficit cutter – mostly due to far-fetched assumptions about economic growth.

The Deficit Path

As written, the bill seems likely to accelerate the US down an already unsustainable fiscal path. The national debt currently stands at roughly 120 percent of GDP. Large-scale credit rating agencies have already downgraded US debt (with the latest explicitly citing the House version of the OBBB), and the bond market has started to show some softness. Most US debt is held by investors, and accounting gimmicks do not fool them.

For too long, the US has avoided facing fiscal reality. The result has been a slow-motion disaster. Interest on our nation’s debt has already become the second-largest government expense, taking up approximately a quarter of all tax revenue. Within a few years, it will eclipse all other spending.

Lawmakers keen to pass the bill have engaged in a smear campaign against the CBO, alleging that their estimates of growth are unduly pessimistic. But MDF has suggested just the opposite before: CBO’s interest rate estimates might be unrealistically sanguine. At a (very possible) 5 percent interest rate, the US will be spending as much as two-thirds of all tax revenues on interest payments alone by 2054, at which time the debt may be as much as three times the size of the economy.

A crisis would almost certainly intervene before then, causing a long-overdue fiscal reckoning and casting indiscriminate and unpredictable suffering far and wide.

Increasingly, policymakers and investors have coalesced around the idea that economic growth is our best hope of forestalling that crisis and mitigating its pain when it happens. At the New York Times Dealbook Summit late last year, Jeff Bezos observed, “You’re going to solve the problem of national debt by making it a smaller percentage of GDP, not by shrinking the national debt.” The year before, then-presidential challenger Vivek Ramaswamy offered 5 percent economic growth as the only realistic solution to the dilemma between tax increases and spending cuts. And shortly after the House passed the OBBB, Elon Musk pointed out that “only radical improvements in productivity can save our country.”

The Growth Mandate

Since growth is not merely an essential part of the remedy for America’s long-term fiscal ailment but also the assumption that makes the House’s bill make sense, the Senate should prioritize provisions in the law that provide the most direct link to growth.

Measured in this way, the most significant weaknesses in the House bill are that the business tax provisions are temporary, creating yet another arbitrary cliff for those making R&D or business infrastructure decisions.

The House Bill achieves “cost savings” by sunsetting the provisions for bonus depreciation, expensing R&D, and incentives around fresh capital investment. The Senate, wisely, is looking to make these measures permanent, at a cost of nearly half a trillion dollars more (per JCT).

Empty Calories at the Pork Buffet

At the same time, arbitrary giveaways waste all the savings gained by the sunset gimmick and then some, while creating expensive economic distortions, complicating the tax code, and rewarding rent-seekers. Altogether, there are some 30+ tax pork provisions, providing more than a dollar of new expense for every dollar saved by sunsetting desperately needed growth provisions in the bill.

Here are some of the porkiest offerings:

Tax

10 yr Cost

(in millions of dollars)

Business development corporation income qualifies for the qualified business income deduction (JCX-22-25R; all other figures taken from JCX 26-25R)

$

10,734

No tax on tips (sunset 12/31/28)

$

39,681

No tax on overtime (sunset 12/31/28)

$

124,016

Enhanced deduction for seniors (sunset 12/31/28)

$

66,263

No tax on car loan interest (sunset 12/31/28)

$

57,673

Tax credit for contributions of individuals to scholarship granting organizations (credit sunset 12/31/29)

$

20,442

Reinstatement of partial deduction for charitable contributions of individuals who do not elect to itemize (sunset 12/31/28)

$

6,947

Exclusion for certain employer payments of student loans under educational assistance programs made permanent and adjusted for inflation

$

11,238

Trump accounts

$

17,345

Exclusion of interest on loans secured by rural or agricultural real property (sunset 12/31/28)

$

1,095

Treatment of certain qualified sound recording productions

$

153

Modifications to low-income housing credit

$

14,110

A Virgin Islands exemption to a law cracking down on tax havens.

$

883

Extension and modification of clean fuel production credit (sunset 12/31/31)

$

45,357

The Golden Dome Program

$

24,746

Eliminating the Tax on Silencers

$

1,478

All told, in tax giveaways and new expenses for (yet more) farm subsidies and energy giveaways, the bill spends over half a trillion dollars that could be spent on making smart cuts permanent and stabilizing the investment base that will grow wages, wealth, and GDP.

If the pork doesn’t kill you, the SALT will.

The first thing to say about the State and Local Tax Exemption (SALT), which is less obviously “pork” but still amounts to a giant handout to wealthy taxpayers in blue states, is that it encourages bad policy.

SALT allows high-tax states to spend recklessly and avoid accountability to their citizens. If states are, as Justice Brandeis once affirmed, “laboratories of democracy,” SALT poisons the experiment by insulating states from negative feedback loops for their bad policy.

Consider two states like New York and Florida - similarly populated states, both of which are high-tourism, high-industry, demographically and economically mixed, and big.

Per capita, New York spends 133 percent more than the Sunshine state. In spite of having arguably the world’s capital city, New York’s population has grown only 4 percent over the last 25 years, while Florida has boomed, thanks in no small part to New Yorkers.

SALT exemptions buffer New York from this trend.

Similarly, California’s budget dwarfs the budgets of Florida and Texas combined.

To what end? Since 2019, the Golden State’s government’s effort to decrease homelessness has spent over $200,000 per homeless person, only to have it increase by 24 percent since Governor Newsom declared fixing the problem to be a “statewide mission.”

Similarly, both New York and California have exploded Medicaid expenditures, with both states spending more per capita on Medicaid than Florida spends in toto.

These developments accelerated while the SALT deduction was $10,000. The House Bill quadruples the benefit; what do we expect will happen next?

So much for SALT as bad policy. It is also highly regressive. As CRFB has shown, while SALT benefits already disproportionately benefit high-earners, raising the cap by $30,000, as the House Bill does, delivers nearly all relief to people earning over $400,000 per year.

Finally, this irresponsible and regressive policy is expensive, totaling $350 billion over the 10-year budget window.

A Plan to Bulk Up the Economy

In the end, the bill is pork-rich and growth-poor at a time when growth needs to be a high-priority policy target. The Senate’s draft version shows serious promise by incentivizing business investment and zeroing out the additions in the SALT cap, for now at least.

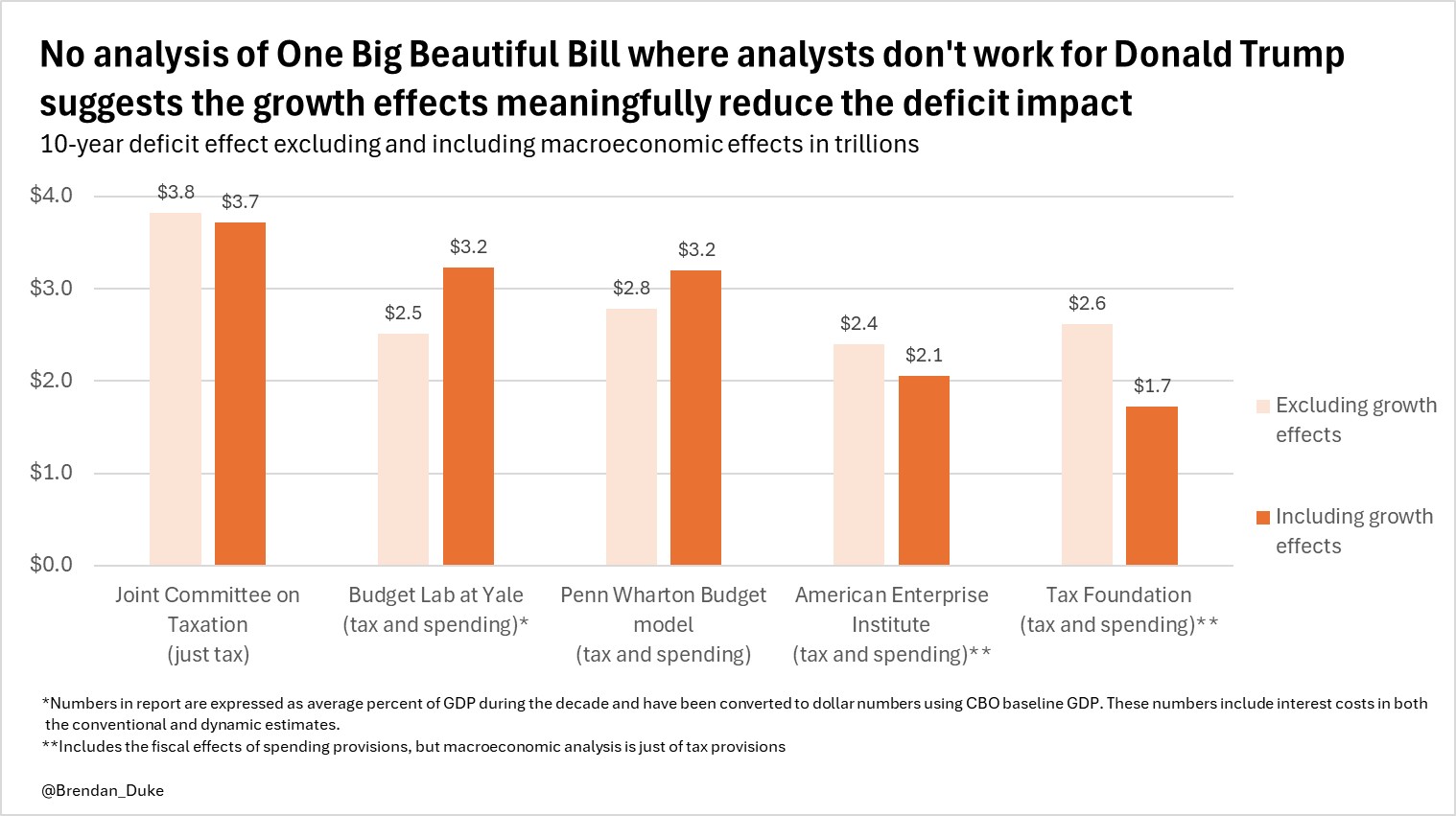

This is a start. Still, debates around tax policy in the country are largely disconnected from reality. House leadership has promulgated growth assumptions of 2.6 percent per year as a result of the bill, along with other legislation they have planned. That would be remarkable, given that most scorers of this bill have found it to have little positive effect on growth (or, like Penn, Yale, and now CBO, even a negative one).

No analysis of One Big Beautiful Bill where analysts don’t work for Donald Trump suggests the growth effects meaningfully reduce the deficit impact

10-year deficit effect excluding and including macroeconomic effects in trillions

*Numbers in report are expressed as average percent of GDP during the decade and have been converted to dollar numbers using CBO baseline GDP. These numbers include interest costs in both the conventional and dynamic estimates.

**Includes the fiscal effects of spending provisions, but macroeconomic analysis is just of tax provisions

@Brendan_Duke

This is the fiscal dilemma: if the TCJA is not extended or made permanent, the American people will experience the most significant tax increase in their history – hardly a pro-growth development. At the same time, debt growth is currently outpacing GDP, interest payments are consuming a quarter of tax revenue, and primary deficits are increasing by 6 percent of GDP each year.

Congress is baking growth assumptions into laws that would otherwise balloon the deficit, when we already need all the GDP growth we can get for a fiscal situation that is careening out of control. We don’t just need to attack the pork in this bill; we need pro-growth reduction in the already-existing primary deficit. Happily, ideas on how to do this are not in short supply.

We cannot afford to waste the runway that economic expansion might buy us on new handouts for pet causes of elected officials; much less can we afford to hamstring growth to make budgetary room for even more pork.

DISCOVER OUR MISSION

Fueling a movement for fiscal responsibility and a stronger American future.

Join the movement